Insurance

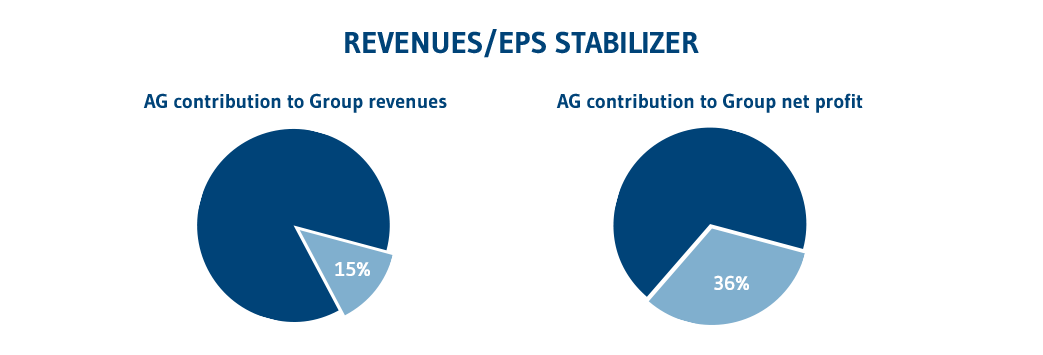

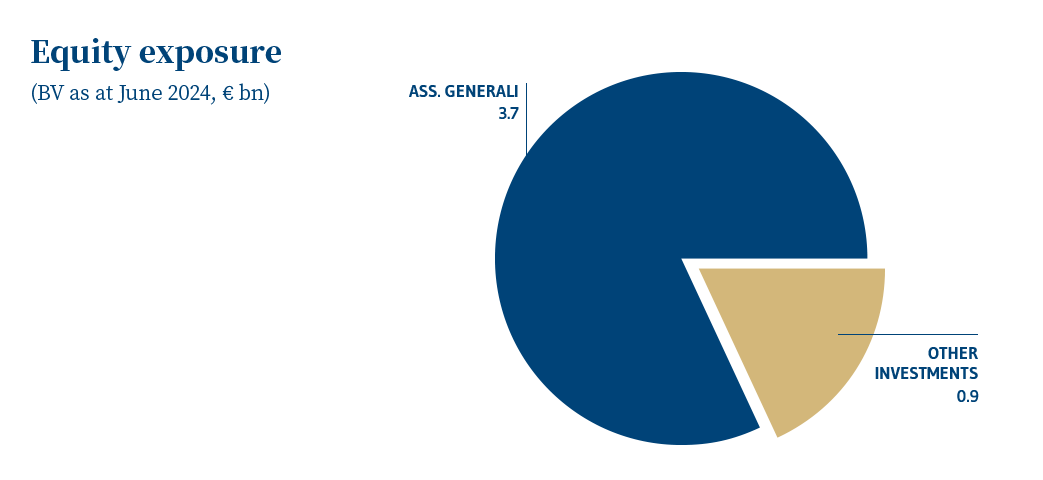

The Insurance Division, which today mainly consists of our 13% interest in Assicurazioni Generali, is a highly profitable source of revenues and earnings decorrelated from the performance of our core banking activity, and a source of capital for growth.

In the last fifteen years, we have profoundly transformed our structure and business model, developing from a bank organized as a holding company to become a specialized financial group, with the ambition of becoming a leading Wealth Manager. Between 2016 and 2019 we sold virtually all the holdings in our equity investment portfolio, with the exception of our approx. 13% stake in Assicurazioni Generali which today represents the Insurance Division’s main asset.

In the next three years, the Insurance Division will continue to contribute positively to both the Group’s top and bottom line, thus improving its stability and visibility.

It also continues to represent an important value option for our Group, in terms of offering available resources that can be used in acquisitions to grow the company.