Objectives by business area

WE AIM TO DELIVER POSITIVE GROWTH IN ALL BUSINESS AREAS, BY LEVERAGING ON OUR DISTINCTIVE: RESPONSIBLE APPROACH TO BANKING, AND FOCUS AND DISTINCTIVE POSITIONING IN HIGHLY SPECIALIZED AND PROFITABLE BUSINESS SEGMENTS DRIVEN BY LONG-TERM STRUCTURAL TRENDS

The Italian wealth management market is one of the largest in Europe, and offers appealing growth margins largely because it is still predominantly “un-managed”. It consists of approx. €5tn of financial wealth concentrated in the Affluent (75%) and HNWI segments, with growth rates that exceed the domestic GDP average rate of growth. Increasing demand for financial protection and planning has also become evident, along with a search for alternative yields, in particular from more sophisticated clients who are looking for portfolio diversification, a trend that has been further accentuated by the recent high inflation.

| Challenges | Opportunities |

|---|---|

|

|

|

|

|

|

Since 2016, the year when growth in the WM became a priority for us, the WM Division has increased by three times in size, in terms of TFAs, salesforce, revenues and profits. Today Mediobanca’s ambition is to establish itself definitively as a leading wealth manager, distinctive for its quality, responsibility, innovation, and value of the offering for Premier and Private clients and for entrepreneurs.

Leveraging on the strong growth recorded in recent years, our Wealth Management has adopted a radical change of approach in WM, creating an operator with characteristics that are unique in Italy. Mediobanca’s strengths (brand, offering content, attractiveness to bankers) will be applied consistently across the Premier and Private Banking segments, generating strong growth and value.

We are accelerating the repositioning of our product offering (liquid and illiquid, “inhouse guided”) and services (offering also Investment Banking services) to Premier and Private clients, leveraging on:

- Mediobanca’s distinctive positioning as Private & Investment Bank

- Synergies with the Corporate & Investment Banking Division

- Our high degree of specialization, which enables us by offering a customized approach

- Our strong relations with Italian entrepreneurial families.

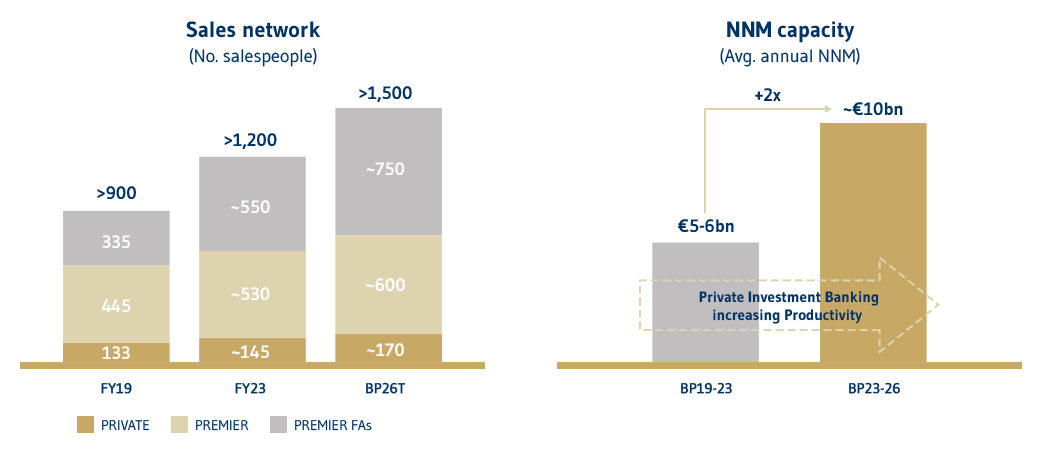

We also expect to make substantial investments in distribution (sales force to increase by 25% to over 1,500 professionals), technology and products.

Highlight

By the end of the three years of the Strategic Plan, the Wealth Management Division:

- Outperform the market in terms of growth in TFAs which will reach €115bn, at a CAGR of +11% (vs +8% for the market), revenues (to over €1bn), and profitability (RoRWA up 110 bps to 4.0%)

- Become a market leader in Italy, comparable in terms of size and profitability with the current leading asset gatherers

- Leverage fully on its distinctive potential deriving from:

- Strong focus on HNWI/UHNWI clients (40% of TFAs, 2x listed players’ average)

- Global advisory approach focused on both entrepreneurs and businesses

- Repositioning and rebranding of CheBanca! as Mediobanca Premier.

- Become the main growth driver for the Group, its second contributor in terms of revenues and first in terms of fee income.

The European Corporate & Investment Banking market continues to reflect a highly challenging environment but still offers attractive opportunities, especially for investment banks specializing in advisory services, which are continuing to gain market share because of their increased client focus and flexible business models.

| MACROTRENDS | OPPORTUNITIES |

|---|---|

|

Challenging economic scenario |

|

|

Strict regulations |

|

| ESG priorities gaining momentum |

|

|

Innovation disruptive for investment banking sector |

|

By leveraging on the distinctiveness of its business model (leadership in reference markets, strong reputation, lean organizational structure, client-focused orientation, ability to attract talent and excellent asset quality) and on a synergic approach with Wealth Management, the Corporate & Investment Banking Division aims to evolve into a pan-European capital-light platform.

In detail the strategy involves:

- Strengthening the CIB franchise in new geographies, sectors, clients and products. Increasing attention is being devoted in particular to the fastest-growing and most innovative sectors, including Tech, Energy Transition and Healthcare, while we are also developing new products, such as CO2 trading, and acquiring BTP Specialist status;

- Strengthening our distinctive positioning as a Private & Investment Bank, through increasing synergies with Wealth Management, and the possibility of serving both entrepreneurs and their businesses at the same time, a differentiating feature in the Italian panorama

- Enhancing our activities in Specialty Finance

- Adopting a different approach to capital management, with special attention being focused on developing capital-light activities. The capital allocated to the CIB Division is also expected to reduce to no more than one-third of the Group’s total capital (vs 50% in 2016).

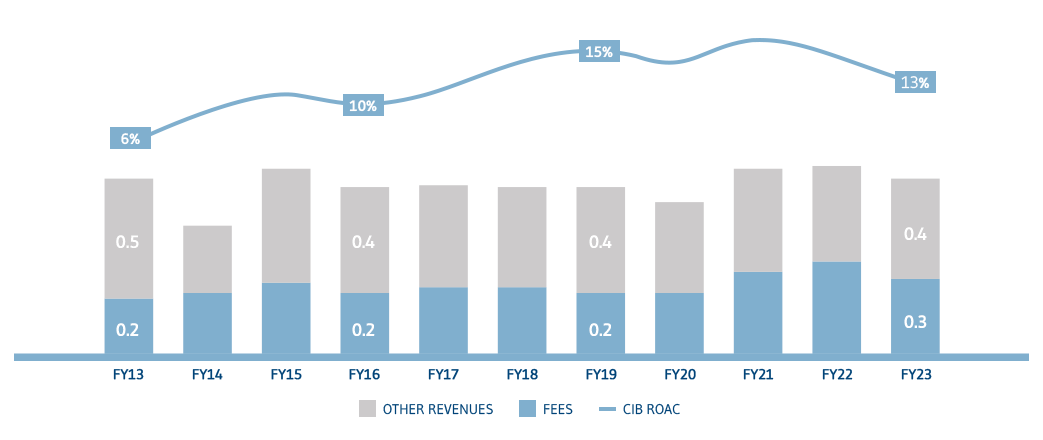

The CIB Division, which historically has been the heart of Mediobanca’s operations, has shown through the years that it is able to deliver resilient results throughout different economic cycles, in terms of both revenues and profitability, helped by effective diversification of its businesses by product, clients and geographies. We have outperformed the sector even in the most challenging years for the sector.

Highlight

By the end of the three years of the Strategic Plan, the Corporate & Investment Banking Division will:

- Increase revenues (to approx. €0.9bn, CAGR + 8%) and profitability (RoRWA up 60 bps to 1.6%);

- Become a stronger, broader and more diversified pan-European platform, with higher non-domestic revenues (from 40% to 55%), and generating more income from capital-light businesses (up from 28% to 40%); advisory services will become the main product in terms of contributing to and growing CIB revenues;

- Strengthen its position of leadership by leveraging on the Private & Investment Banking model and unlocking the clear potential at intra-Group level (in particular with Private Banking, Messier et Associés and Arma Partners), confirming its position as partner of choice for medium-sized and large companies in its reference markets (in particular Italy, France and Spain);

- Become the Group’s main source of capital optimization (RWAs down 13% in 3Y to €17bn) and its second-largest contributor in terms of growth in revenues and fee income.

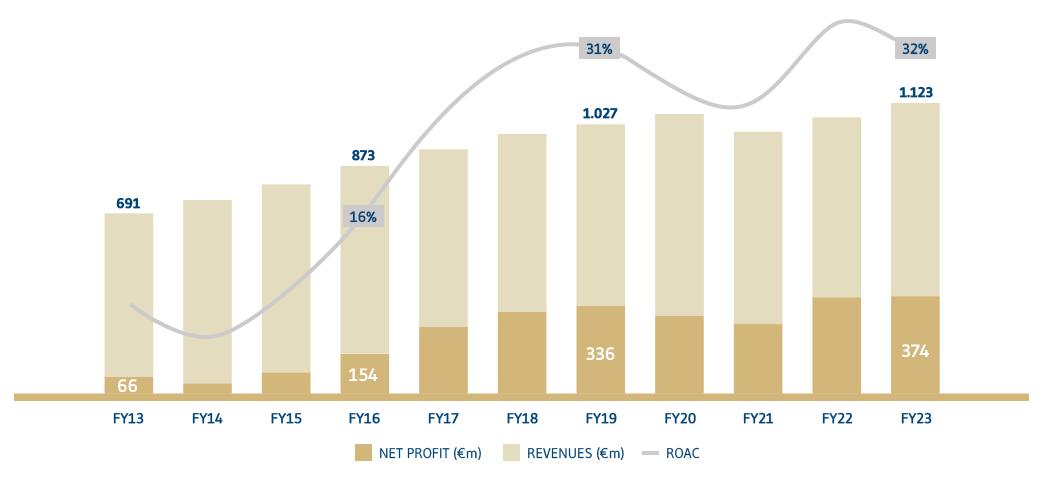

Compass has been operating in the consumer credit industry since 1960, and has been one of the top three domestic players in this sector for more than fifteen years. It has established its leadership in the most valuable product segments and is now looking to grow, by leveraging on its own strengths and the long-standing, solid and consistent support ensured by the Mediobanca Group.

The Italian market offers significant growth opportunities: it is less mature than other European economies, with opportunities to capture market share as traditional banking networks scale back their footprints.

| Consumer credit market | Compass’s strengths |

|---|---|

|

Estimated growth in Italy CAGR 2023-26: + 3.5% |

|

| Change in client behaviour |

|

|

Shift in the credit cycle |

|

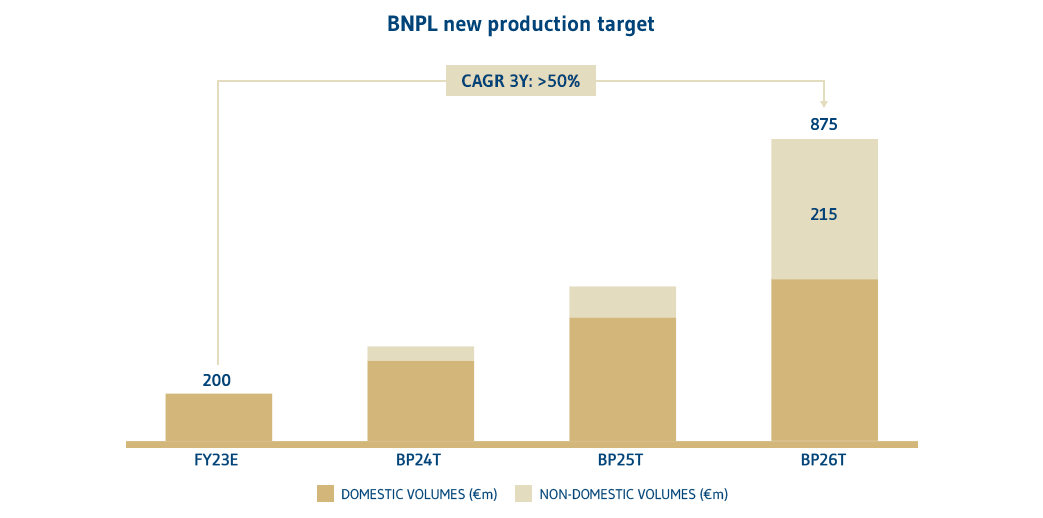

By leveraging on its distinctive features (consolidated client base, broad and diversified distribution, high scoring and pricing capabilities, solid asset quality), Compass will further consolidated its leadership position on the domestic market through an upgrade of its service model and enhancement of its direct digital channels. The 2023-26 provides for:

- Major enhancement of geographical distribution: no. of POS to increase by 10%, from 310 to around 340;

- Significant investments in technology, to develop the best digital lending platform: the adoption of sophisticated Artificial Intelligence engines, combined with Compass’s established credential is credit risk assessment, will allow digital personal loan volumes to increase further, and new instant lending solutions to be launched for the best clients;

- Creation of an integrated solution between physical and digital channels;

- Development of innovative products, for e-commerce in particular, and of Buy Now Pay Later (BNPL) operations.

Highlight

By the end of the three years of the Strategic Plan, the Consumer Finance Division will:

- Grow revenues (to €1.3bn), while maintaining high profitability (RoRWA 2.9%);

- Upgrade its leading position in Italy as a multichannel platform;

- Access new markets and client segments digitally rather than physically;

- Implement derisking policies, without prejudice to its high efficiency and asset quality indicators;

- Confirm its position as the Group’s main source of revenues and net interest income.

Virtually all the Insurance Division consists of the Group’s investment in Assicurazioni Generali (equal to 13%). The division will continue to contribute positively to revenue and profit creation at Group level, thus improving stability and visibility.

Highlight

The value of the investment is based on its:

- Excellent profitability, which has been further strengthened by the permanent application of the Danish Compromise;

- Decorrelation vs macroeconomic scenario and traditional banking activities;

- High cashflow;

- Potential as value option for the Mediobanca Group in providing available resources that could be used in the event of appealing opportunities for growth via acquisitions.