Overview

We have been pioneers in consumer credit in Italy and are still among the market leaders in this segment. Our consumer credit arm Compass Banca stands out because of its solidity, sustainability and innovative approach, focusing increasingly on direct distribution and digital channels.

We have stood alongside Italian households from our earliest days, helping them meet their needs for finance. We have been operative in consumer credit since 1960 through Compass Banca, which, with a market share of 14% (excluding credit cards), has been one of the sector’s leading operators for over a decade.

With its indepth understanding of the sector, acquired over its many years in business, including through data collection and analysis, Compass Banca is able to identify, assess and serve customers effectively, with increasingly innovative products that are able to capture the new market trends and meet the changing requirements of individuals and families.

- Ability to combine solidity, reliability and strong appetite for innovation

- Responsible approach to banking

- Leadership position (third-ranked market operator)

- Broad and established client base

- Extensive and integrated multichannel distribution platform, with growth in direct distribution

- Management approach geared towards value (risk-adjusted return the only relevant metric used in decision-making for new loans)

- High scoring, pricing and risk appreciation capabilities

- Excellent asset quality and effective credit recovery processes

Mediobanca’s 2023-26 Strategic Plan “One Brand-One Culture” provides for growth in the Group’s Consumer Finance division, confirming Compass’s leadership position, by enhancing direct and digital distribution and through the development of innovative products.

In particular:

- We are strengthening in direct distribution (327 branch offices as at 30 June 2024)

- We are enhancing our digital channels, which in FY 2023-24 generated 35% of the volumes of personal loans granted through the direct channels

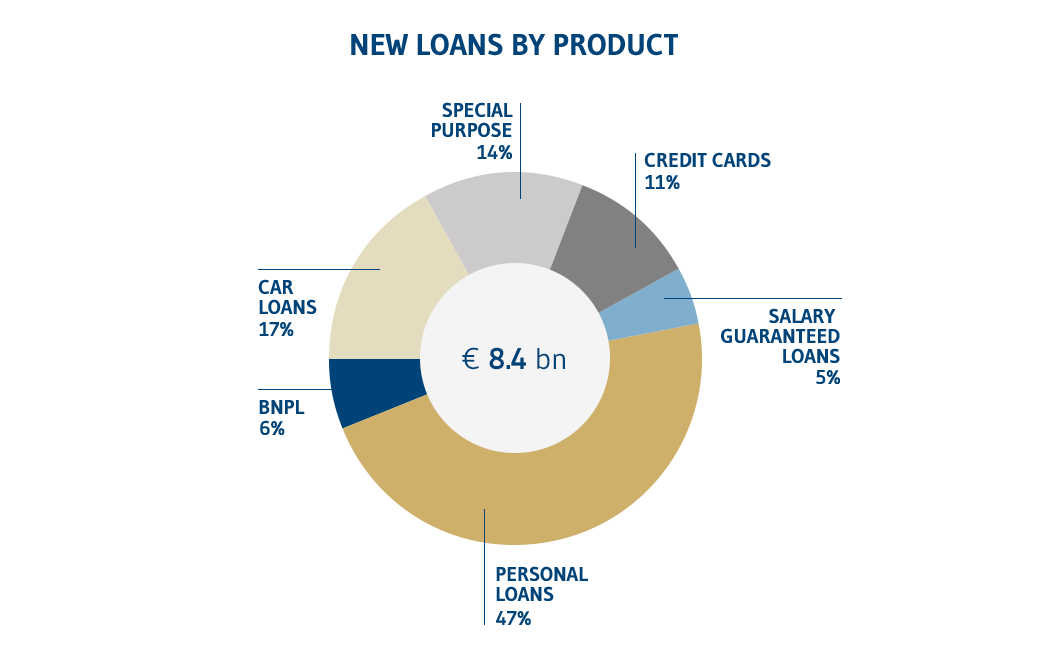

- We are introducing innovative products, in particular in Buy Now Pay Later (create link to new page “What we can offer”): a service that meets consumers’ new purchasing habits, and enables us to acquire new clients