What we can offer

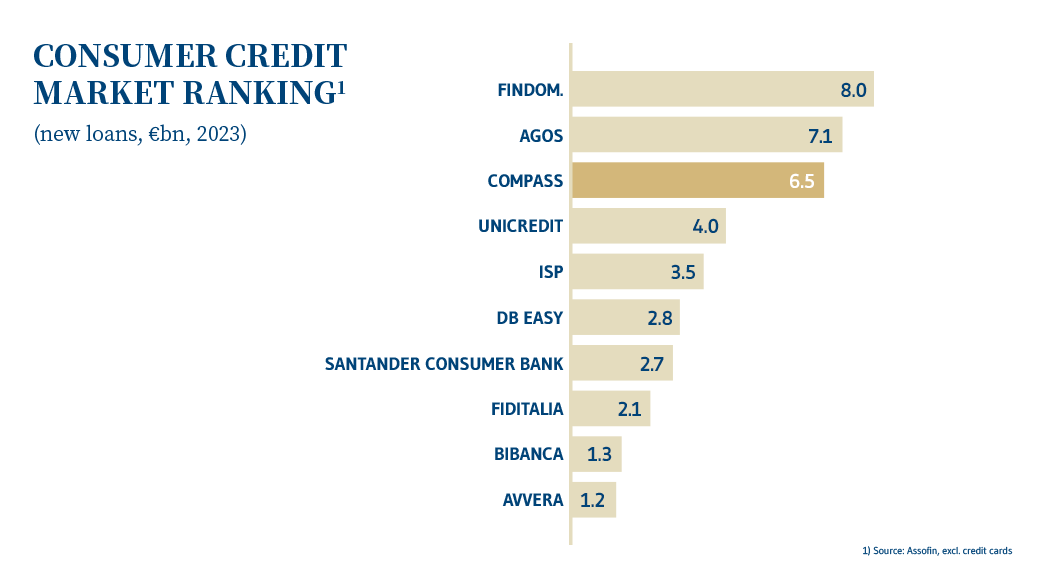

Compass, the third leading consumer credit operator in Italy, has always guaranteed the highest standards in terms of quality, speed and efficiency, to ensure that its clients are satisfied and to retain their loyalty.

Compass is a solid and reliable partner for Italian families, able to stand with them and respond to their needs for finance increasingly effectively, on the back of its:

- Geographical proximity (327 POS throughout Italy)

- Development of digital channels. The new platform, which has been renewed in terms of user experience, enables new clients to be onboarded rapidly, increasing the speed with which loans are approved (more than 80% of applications are granted within the space of an hour) and to enable new, dedicated products to be channelled to the existing client basis (such as instant lending, which is addressed to Compass clients with a solid track record, enabling them to have new loans approved in just one minute).

Compass’s product offering includes:

- Personal loans, the company’s main areas of business

- Special-purpose loans: not just cars and motorbikes, but also electronic consumer goods, furniture and travel, offered through the use of innovative instruments such as BNPL (Buy Now Pay Later)

- Credit cards

- Salary-backed finance

- Home insurance services.

Compass, which has always been focused on product innovation, is developing increasingly simple, immediate and customizable solutions, able to meet the new trends in digitalization and consumption more effectively.

The platform allows clients to apply for loans from the comfort of their own home, uploading the documentation online, and receiving a response within an increasingly shorter timeframe.

HeyLight: a new consumer credit product

Compass was a pioneer in Buy Now Pay Later (BNPL), the possibility of paying for an in-store or online purchase in instalments, through its PagoLight product. Now a further step forward has been taken with the transformation of PagoLight into HeyLight, a new international BNPL ecosystem which is able to offer an improved experience for both customers and merchants:

- In-store: this solution is offered in 29,000 physical points-of-sale in Italy, making Compass the leading operator in this sector.

- Online: Compass has entered into a partnership with Nexi, the paytech company that is a market leader in Europe, which will allow HeyLight to be integrated into Nexi’s e-commerce payment gateway. Through this partnership, merchants will be able to offer their clients an innovative solution for deferring their online payments.

- In Switzerland: following the acquisition of HeidiPay which was completed in October 2023, HeyLight is now offered by around 500 distributors and brands in Swiss territory.